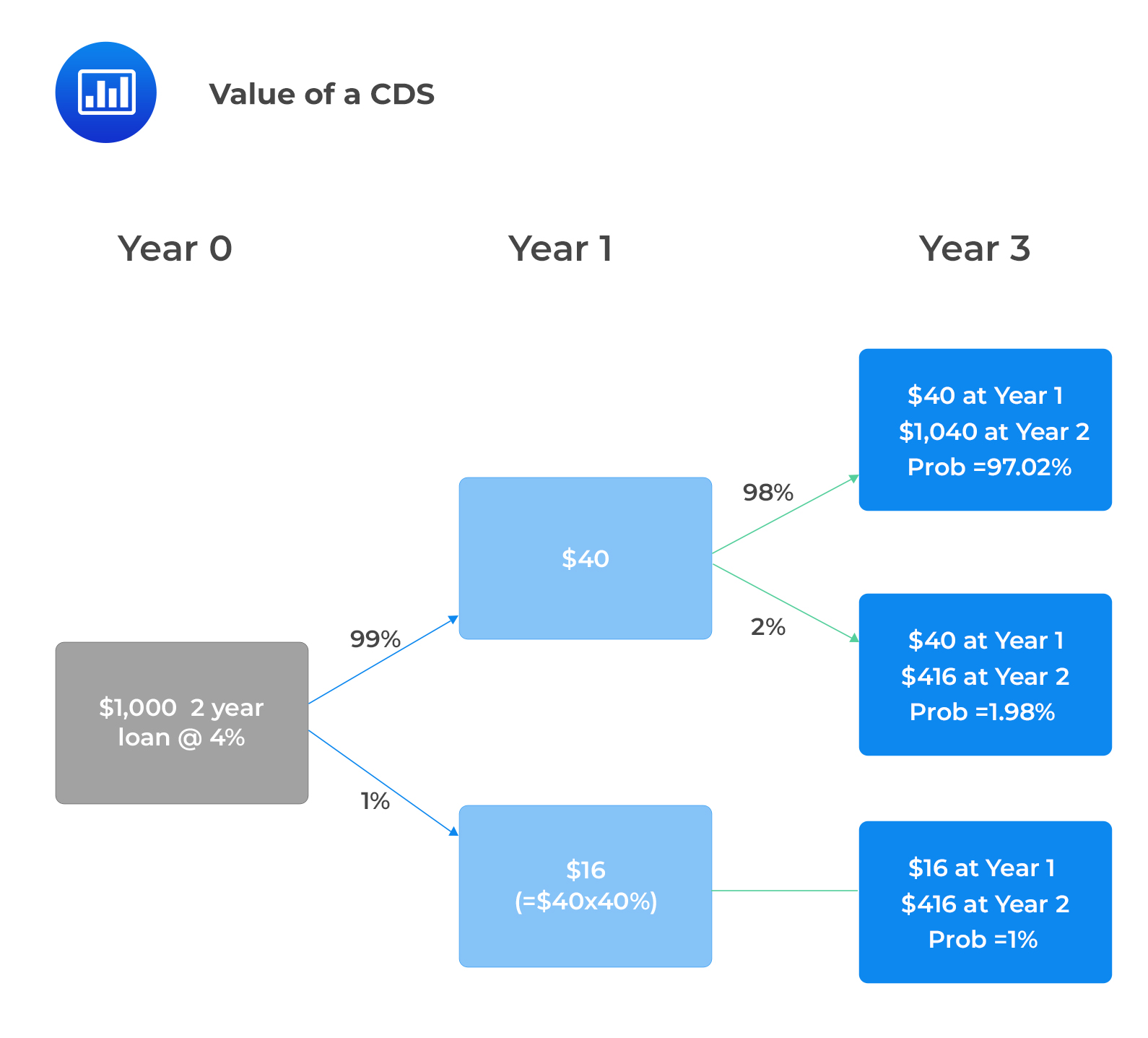

Credit Default Swap (CDS). We are often worried when we lend money… | by Farhad Malik | FinTechExplained | Medium

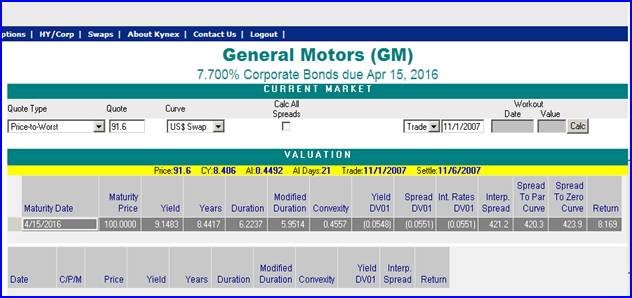

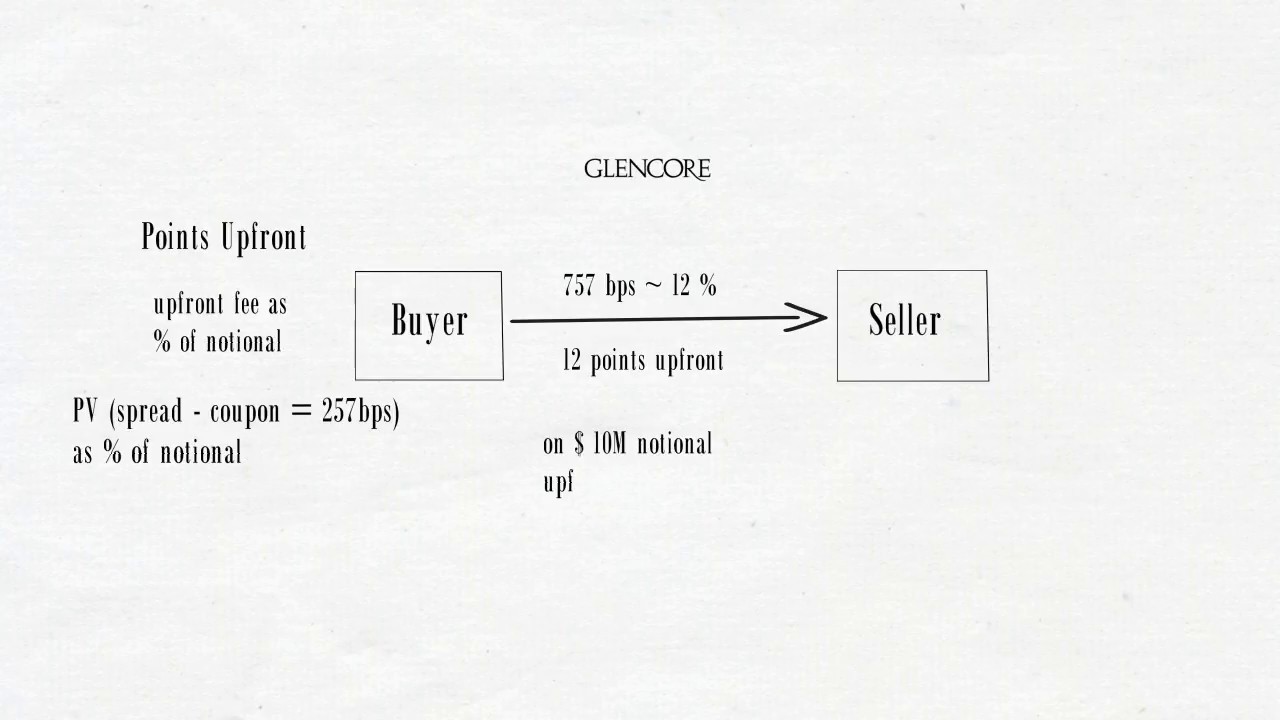

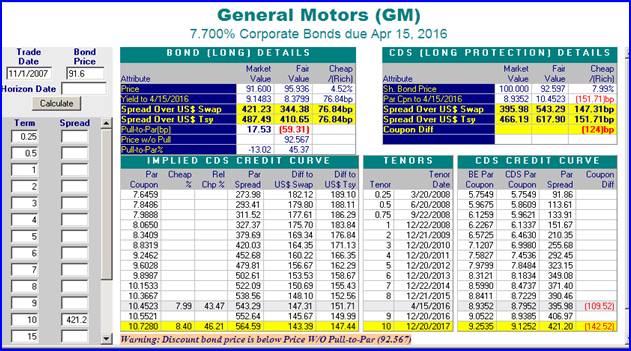

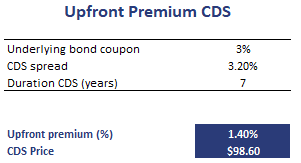

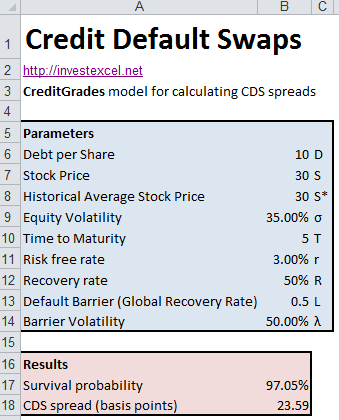

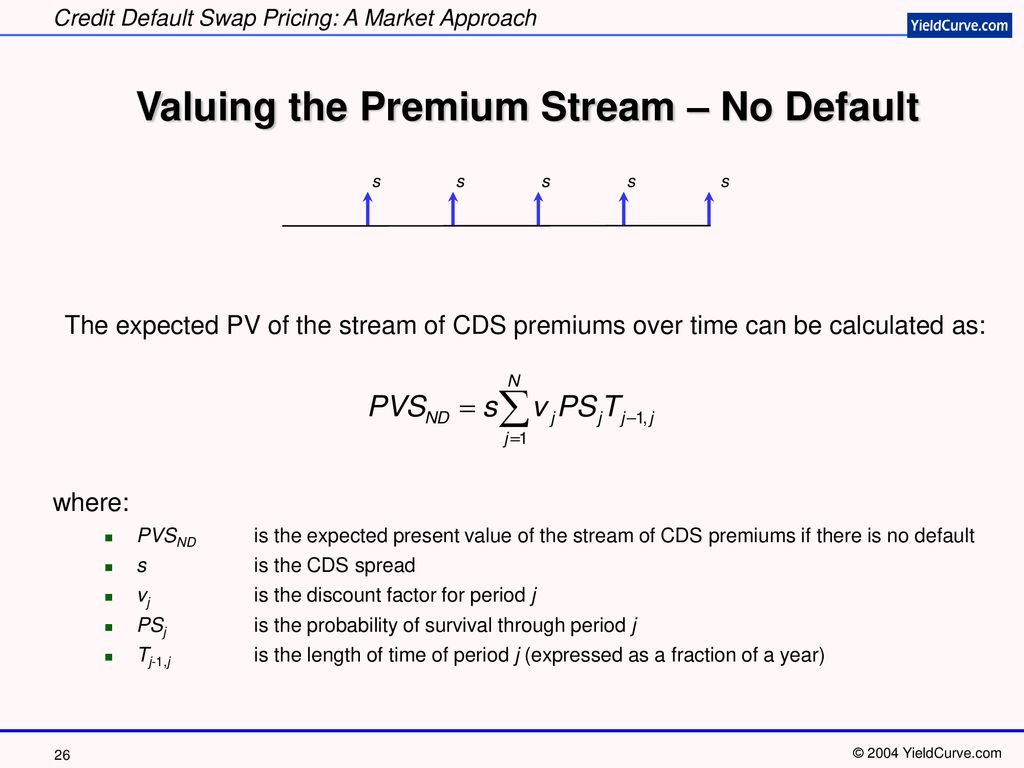

Ming Zhao on X: "4/ How are CDS swaps priced? TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the